Homeownership Realities

Low to moderate-income families who receive assistance purchasing homes open up opportunities for subsidized homeless people to be placed into those vacated apartments. The creation of more affordable housing opportunities has a far-reaching effect on communities desperately in need of solutions to their housing shortages.

With Help You Can Afford to Own a Home!

Renting vs Buying

This rental vs mortgage chart explains why renting should be considered the steppingstone towards a secure profitable investment such as property ownership. Looking at the chart it becomes clear that paying rent, at a rate of $500-$2,000 monthly, over a 5-30year time period compares unfavorably to purchasing a $120,000 property over that same period of time.

Renting is a necessity since we all need a place to live independently. However, anywhere between 2-5years should be plenty of time for any financially responsible determined individual with sufficient income to position themselves towards the purchase of property. It takes time to establish credit and repair damaged credit to the point that a lending institution will be willing to provide us with a mortgage. Otherwise, we are giving away money that should be going towards property ownership that will eventually yield a return on our investment and could potentially build generational family wealth.

Unless we were born wealthy or inherited enough money to pay cash, we must all rent until we are in position to purchase property using a mortgage loan. Consistent on-time monthly payments lower the principal balance on the mortgage loan used to finance the property while the value of the home continues to increase at the same time. The difference between the value of a property and the loan balance is called property equity. For example, when a property has a sell value of $150,000 and a 1st mortgage balance of $80,000 the property equity is $70,000. Property owners with good credit can take out a 2nd mortgage or Home Equity Line of Credit (HELOC) using up to $55,000 (90% of the total property sell value) of the $70,000 property equity to invest in wealth building. Learn how to become a pre-qualified homebuyer.

Homeownership is a sound wise investment

Why is homeownership important for wealth?

Providing affordable financing and refinancing loans at lower interest rates help low-income households to build equity in their homes. ... Low-income homeowners with sustained ownership and affordable loans have higher wealth accumulation — both housing and non-housing wealth — than comparable renters.

US Homeownership Rate

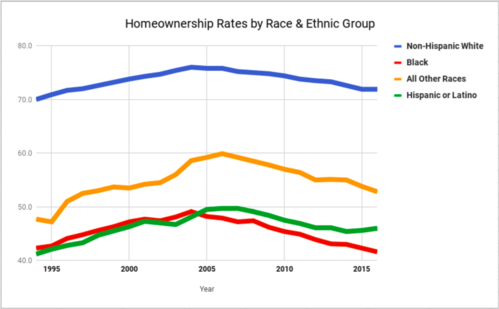

Racial discrimination is an intrinsic natural part of affordable housing, homeownership programs, government and nonprofit organization sponsored projects in America. Housing mandatory segregation by local, state and federal governments across the country separated Americans according to the color of their skin. In 1934 the Federal Housing Administration (FHA) was established. They provided taxpayer dollars in the form of subsidized free grant monies to white American builders who were mass-producing whites only affordable housing subdivisions across the country. A practice known as "white flight." These white suburban homes had full Federal Housing Administration loan guaranteed mortgage insurance while at the same time the FHA refused to provide mortgage insurance for all loans in or near African American communities. This practice is known as "redlining." In many parts of the country these practices still exist today.

African Americans/blacks, as well as Hispanics, are far behind the curve when it comes to understanding the value of homeownership. There have been many discriminatory barriers placed in the pathway of homeownership for them. Those barriers coupled with other issues help to keep black homeownership rate consistently lower than every other racial group in America. Alpha would like to see that situation change for the better.

Hispanics, are far behind the curve when it comes to understanding the value of homeownership. There have been many discriminatory barriers placed in the pathway of homeownership for them. Those barriers coupled with other issues help to keep black homeownership rate consistently lower than every other racial group in America. Alpha would like to see that situation change for the better.

Homeownership increased for all races under the President Bill Clinton administration's affordable housing programs during the 8 years (1992-2000) of his presidency. When President George Bush II took office in 2000 that positive trend changed after his administration cut or defunded those affordable housing programs in favor of tax breaks for the wealthy. Homeownership decreased for all races as a result, but minority communities were hit the hardest.

The value of homeownership is not lost on white Americans. They understand the importance of owning a home over renting an apartment. It is better to spend 30 years paying off a home mortgage loan then spending 30 years building generational wealth for landlords. When properly taken care of a house increases in value, its built-up home equity can be used towards children's college education, major purchases or other investments.

What is the current state of homeownership by race in the US?

The US homeownership rate is defined as the number of owner-occupied housing units divided by the total number of occupied housing units. According to data from the US Census Bureau, the homeownership rate in the US was 64.6% in 2019, down from its peak of 69% in 2004 before the 2008 financial crisis.

Homeownership in the US varies significantly by race and ethnicity. In 2019, the homeownership rate among white non-Hispanic Americans was 73.3%, compared to 42.1% among Black Americans. This 31.2 percentage point difference was the largest gap since the Census’ time series began in 1994. Between 1994 and 2019, the white homeownership rate increased by approximately 3.3%, while the Black homeownership rate declined by 0.2% over the time period.

While homeownership was lowest among Black Americans, other race groups also owned homes at lower rates than white Americans in 2019. The homeownership rate was 47.5% among Hispanic or Latino Americans, 50.8% among American Indians or Alaska Natives, and 57.7% among Asian or Pacific Islander Americans. But in contrast with the rate among Black Americans, some groups experienced increases in homeownership since 1994. Homeownership rates increased by over six percentage points among both Hispanic or Latino and Asian or Pacific Islander Americans.

Homeownership is a major component of individual wealth in America, and racial disparities in homeownership therefore play a role in determining how wealth is distributed across demographic groups. For more data on the demographics of income, plus education, policing and more, visit the race in America page.

Source: https://usafacts.org/articles/

homeownership-rates-by-race/

At some point it becomes an individual choice to continue accepting unfavorable life circumstances confronting us or decide to make an earnest effort to fight for better living conditions. Change has to become personal. We must find ways to overcome societal and self-placed obstacles to attain an improved quality of life. Nobody can realistically expect to wait for help from a government/society that doesn't care whether its tax paying citizens live or die. People are left to create their own change or continue to live in despair. If you are fed up and ready to become a part of creating an improved better life for yourself and your family become an Alpha VOLUNTEER.

Sweat Equity Program

Sweat equity is a way of assigning a dollar value to work, expertise, or time when money is in short supply or when the dollar value doesn't reflect the full value of a venture or a project. For example, employees given stock or options instead of wages are being paid in sweat equity. It's about doing the work — the hard work — to bring an idea to life. When property owners physically make improvements on their properties, they do not immediately pay themselves cash for the labor performed the way they would pay someone else, that payment is received in the form of sweat equity from the increased value of that property when it is sold. There are nonprofit home building programs that allow the homebuyers to participate in the building process of their home and use their sweat equity as a down payment/discount off the purchase price.

From Homeowner to Investor

Purchasing a home is a solid strong major investment, one that pays dividends in multiple ways. The value of homes continues to rise over time and the amount of the mortgage decreases with each payment made. A home builds up equity, the difference between what you owe on your mortgage and what your home is currently worth. For example, if you owe $125,000 on your mortgage and your home is worth $185,000 then you have $60,000 in equity in your home. That is the amount you could use as down payment to purchase your next home. You also have the option of borrowing some of that $60,000 for business investments, purchases, education, vacation or anything else you decide to use it on.

People who desire to build generational wealth use their home equity to invest in profitable ventures or businesses that build wealth. Profits from those investments can be used to pay-off their mortgages, other debt and/or grow wealth over a shorter period of time.

Back to Homeownership page

.png)

P.O. Box 085405 - Racine, WI

P.O. Box 085405 - Racine, WI Our Philanthropy

Our Philanthropy